SERRES FARMS | New Construction Homes in Oregon City, OR

Where thoughtful design meets everyday living.

Thoughtfully designed homes built by Forrest Ridge Homes—created for real life, real families, and long-term value.

If you’ve already walked the homes, this is where you come back to picture life inside them.

Why Serres Farms Exists

Designed with purpose. Built to last.

Serres Farms was built by Forrest Ridge Homes, a local builder known for prioritizing craftsmanship, livability, and long-term durability over quick trends.

These homes weren’t designed to impress for five minutes—they were designed to support real life for years to come.

Why Choose Serres Farms

The Lifestyle that fosters the convenient conveniences.

Serres Farms offers a neighborhood feel without sacrificing convenience—close to parks, schools, and everyday essentials, while still feeling tucked away.

It’s a place where evenings slow down, weekends feel full, and home actually feels like home.

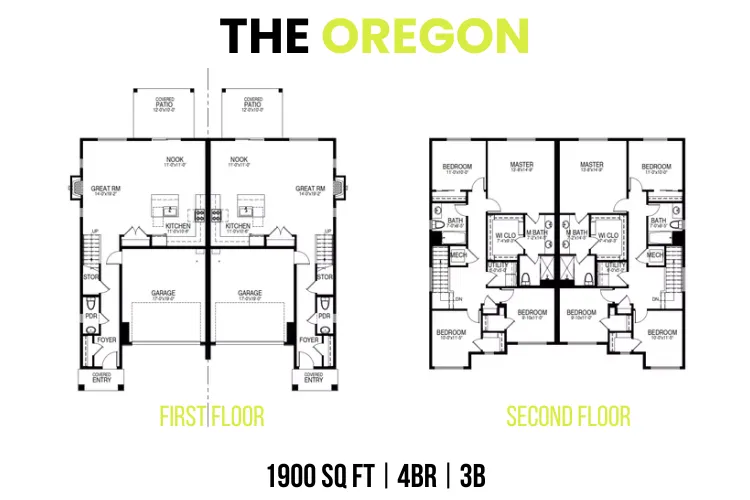

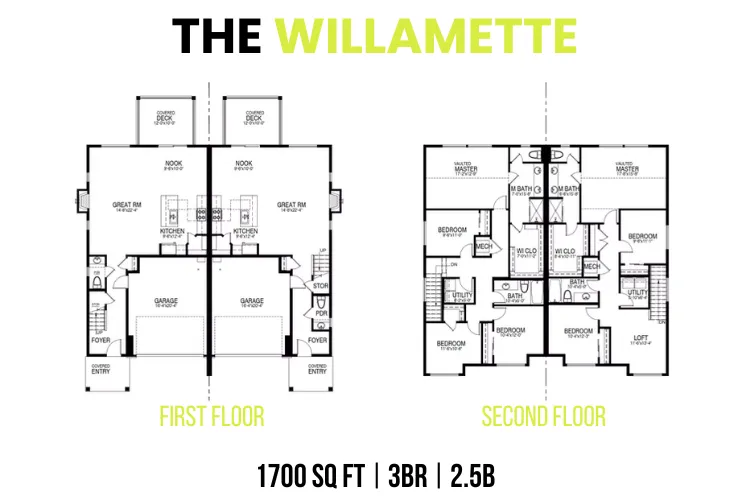

The Homes

Rooted in Oregon City. Positioned for convenience.

The homes at Serres Farms balance modern design with functional living—open layouts, intentional storage, and finishes that age well over time.

New construction means fewer surprises, lower maintenance, and peace of mind—especially for first-time and move-up buyers.

Is Serres Farms a good option for first-time homebuyers?

Yes — Serres Farms is especially well-suited for first-time and early move-up buyers. The homes are thoughtfully designed to balance comfort, functionality, and affordability, while new construction helps reduce maintenance surprises during the early years of ownership.

Many buyers see Serres Farms as a strong stepping stone: a place to build equity, settle in, and grow into their next chapter with confidence.

What makes new construction at Serres Farms different from resale homes?

New construction at Serres Farms offers modern layouts, updated systems, and the peace of mind that comes with brand-new materials and construction standards.

For many buyers, this means fewer immediate repairs, lower maintenance early on, and a smoother transition into homeownership — especially compared to older resale properties.

What types of buyers are most drawn to Serres Farms?

Serres Farms attracts a wide range of buyers — from first-time homeowners and young families to downsizers and professionals seeking low-maintenance living.

The common thread is buyers who want a well-built home that supports real life without unnecessary complexity.

What are the benefits of living in an attached home at Serres Farms?

Living in an attached home at Serres Farms offers a smart balance of privacy, efficiency, and long-term value. These homes are built to modern construction standards that prioritize sound reduction, energy efficiency, and thoughtful layouts: meaning they often feel quieter and more private than buyers expect.

Attached living can also translate to lower overall ownership costs. Shared walls typically improve energy efficiency, and the reduced exterior footprint means less maintenance over time compared to larger detached homes.

From an investment perspective, well-built attached homes in growing areas like Oregon City continue to attract strong demand. Their accessibility, lower maintenance, and affordability relative to detached homes make them appealing not only today, but to future buyers as well.

For many homeowners, attached living at Serres Farms isn’t a compromise — it’s a strategic choice that supports both lifestyle and financial goals.

Five Reasons to Choose a Forrest Ridge Home

UNCOMPROMISING CRAFTSMANSHIP

Built with quality that stands the test of time.

SMART, MODERN LIVING

Integrated smart home features simplify daily life.

ENERGY-EFFICIENT BY DESIGN

Save money and live sustainably with advanced construction methods.

SEMI-CUSTOM OPTIONS

Make your home truly yours with flexible design choices.

COMMUNITY-DRIVEN

They don't just build homes, they build communities that feel like family.

Financing that breaks barriers. Empower your homeownership journey online.

Delivering personalized, dynamic mortgage solutions that engage clients and drive real results.

Inspiring Homeownership Journeys

Who These Homes Are Perfect For

The First-Time Homebuyer Ready to Own

“I want something that feels like a real home — not a temporary step.”

Serres Farms is ideal for first-time buyers who are ready to move beyond renting and into ownership with confidence. These homes offer modern layouts, new construction reliability, and a manageable footprint — making the transition into homeownership feel exciting rather than overwhelming.

For buyers who want pride of ownership, predictable costs, and a place that actually feels like theirs, Serres Farms is often the right place to start.

The Growing Household Needing Smart Space

“We don’t need bigger — we need better.”

These homes resonate with buyers who value functionality over excess. Thoughtful layouts, defined living spaces, and low-maintenance living allow households to focus on time together instead of constant upkeep.

Whether it’s a young family, a couple planning ahead, or someone balancing work and home life, Serres Farms supports busy seasons without sacrificing comfort.

The Strategic Move-Up or Reset Buyer

“I want a smart move that supports my next chapter.”

Serres Farms attracts buyers who are intentionally choosing efficiency and value. Some are stepping out of older homes with high maintenance demands. Others are repositioning financially or lifestyle-wise.

These homes offer a clean slate — new systems, modern design, and a fresh start — without the pressure of oversized properties or unnecessary complexity.

The Lifestyle-Focused Buyer

“I want my home to support my life, not run it.”

For buyers who value simplicity, balance, and flexibility, attached living at Serres Farms makes sense. With less exterior maintenance and thoughtfully designed interiors, homeowners gain time back — for family, hobbies, rest, or simply enjoying where they live.

This is an ideal fit for buyers who prioritize quality of life and long-term sustainability over square footage alone.

Next Steps...

Get Pre-Approved

Request Availability

...and maybe tour again for fun...

Lock in your Home

Experiences That Build Trust

Lending Built on Conviction.

Darby’s approach to mortgage lending isn’t transactional—it’s relational. She believes every loan is an opportunity to serve others through truth and transparency. Her process helps families feel seen, supported, and equipped to step into their next chapter with confidence.

Integrity Over Image

Doing what’s right—whether seen or unseen.

“Integrity is everything to me—and I love how Proverbs says, ‘whoever walks in integrity walks securely.’ That’s exactly how I approach my work—I’d rather walk securely in truth than stumble trying to impress.”

- Darby Lamping

Education Changes Everything

Equipping clients to make informed, confident choices.

“I think God calls us to teach and to seek understanding—not just in faith, but in all things. When people understand, they walk in peace instead of fear. That’s why I love educating my clients—it’s freeing for them.”

- Darby Lamping

Faith

Guiding every step with grace, discernment, and purpose.

“Faith is what keeps me grounded—it reminds me that this work is service. Colossians 3:23 says, ‘Whatever you do, work at it with all your heart, as working for the Lord.’ That’s exactly how I try to show up—with excellence and grace, knowing it’s about serving people, not transactions.”

- Darby Lamping

What Our Clients Say

We’re proud of our work—here’s what our clients have to say about partnering with us:

Client-Focused Approach

"I simplify the mortgage process and guide clients toward confident homebuying decisions."

Richard Jackson

Loan Officer

Jane Doe

Lorem ipsum

Trusted Advice

"My expert advice ensures clients receive the right loan options for their needs."

Sarah Ahmed

Mortgage Specialist

Jane Doe

Aenean tincidunt

Streamlined Process

"I lead clients through every step, making the homebuying experience seamless and stress-free."

John Smith

Loan Processing Manager

Jane Doe

Proin ac arcu iaculis

Clear Communication

"Every interaction is clear and informative, ensuring clients feel supported at every stage."

Alicia White

Client Relations Manager

Jane Doe

Lorem ipsum

Client-Centered Guidance

"I focus on delivering personalized solutions that align with each client's unique homeownership goals."

Mia Harper

Senior Loan Officer

Jane Doe

Aenean tincidunt

Expert Mortgage Solutions

"My goal is to provide clients with the best mortgage options to suit their financial needs."

Noah Blake

Mortgage Advisor

Jane Doe

Proin ac arcu iaculis

Efficient Service

"I ensure a smooth and quick approval process, making homeownership dreams a reality."

Chloe West

Loan Officer

Jane Doe

Lorem ipsum

Transparent Advice

"I provide clear, honest guidance, helping clients make informed decisions at every stage."

Ethan Hale

Mortgage Specialist

Jane Doe

Aenean tincidunt

Tailored Solutions

"I offer customized mortgage plans that match each client's needs, ensuring the best fit."

Isla Ford

Loan Consultant

Jane Doe

Proin ac arcu iaculis

© 2026 Darby Lamping | Vision Mortgage Group - All rights reserved.